According to statistics, on March 26, the stablecoin financial system was valued at $135 billion, with the highest stablecoins representing $31.8 billion or 75% of the $42.17 billion in 24-hour international commerce quantity throughout the complete crypto market. In the final two weeks since March 11, 7.06 billion USDC and 351.57 million BUSD have been redeemed. Meanwhile, from March 14 to March 26, the variety of tether stablecoins in circulation elevated by 6.12 billion.

Stablecoin Circulation Changes

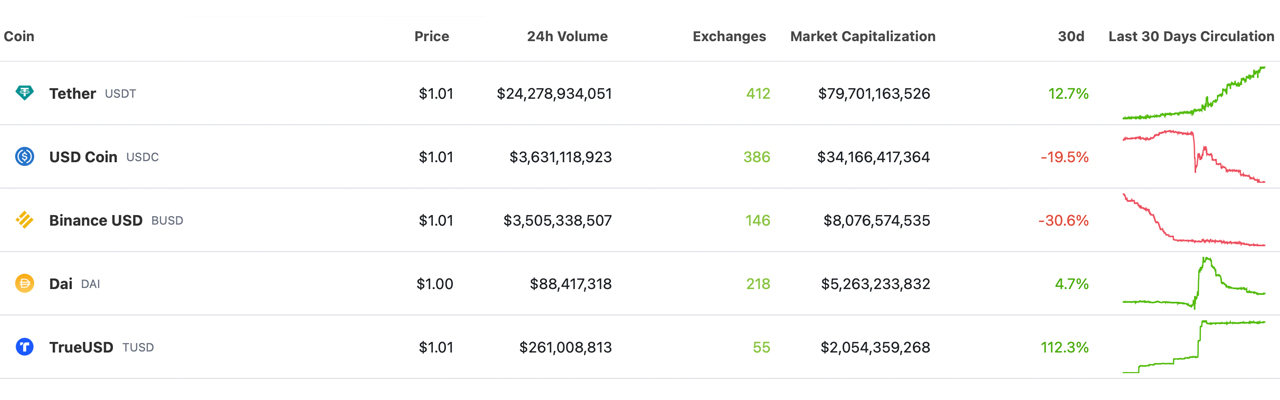

In latest weeks, the provides of some stablecoins have decreased whereas others have elevated. Today’s high ten stablecoins embody USDT, USDC, BUSD, DAI, TUSD, FRAX, USDP, USDD, GUSD, and LUSD. According to statistics for the final month, USDC, BUSD, and GUSD skilled double-digit reductions in provide. The different high ten stablecoin belongings recorded provide will increase, with TUSD’s provide doubling or rising 112.3% increased than it was 30 days in the past.

Among different stablecoin belongings, liquity usd (LUSD) rose 16.2% and tether (USDT) elevated by 12.7% during the last month. LUSD now has a market valuation of round $267.70 million, USDT’s market capitalization has risen to $79.70 billion, and TUSD’s market valuation has grown to $2.05 billion. On the opposite hand, USDC’s variety of cash in circulation has dropped by 6.12 billion since March 11. Statistics for the final 30 days point out that USDC misplaced 19.5% of its provide in comparison with final month.

BUSD and GUSD skilled the biggest reductions, with GUSD dropping 31.6% of its provide during the last 30 days. BUSD has diminished its provide by 30.6% since final month, and its market valuation is simply above $8 billion. According to Nansen’s proof-of-reserves device, $7.3 billion BUSD is held by Binance. The stablecoin DAI issued by Makerdao has seen a 4.7% enhance in circulation. Over the final month, FRAX recorded a 1.9% enhance, and USDP has risen 8.5%.

What do you assume the longer term holds for stablecoins and their function within the crypto market? Will we see continued progress and adoption or will they face new challenges and obstacles? Share your ideas within the feedback part beneath.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational functions solely. It is just not a direct supply or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, straight or not directly, for any injury or loss triggered or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or providers talked about on this article.