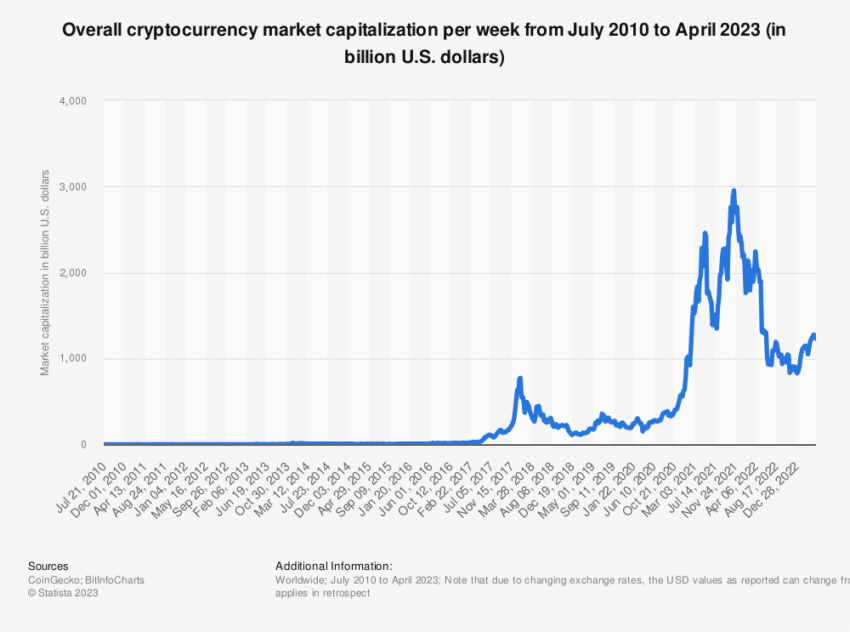

In a shocking flip of occasions, China has begun sending indicators that it would rethink its crypto ban. Consequently, offering hope for a probably profitable crypto market sooner or later.

The present regulatory developments in Hong Kong and technological advances in mainland China counsel that the crypto ban would possibly lastly be lifted.

A Brief History of China’s Crypto Ban

China’s relationship with the cryptocurrency business has been tumultuous since 2013, when the nation first imposed strict restrictions. The first ban got here in December of that yr when the People’s Bank of China (PBoC) and different monetary watchdogs prohibited banks from dealing with transactions associated to Bitcoin.

Bitcoin was deemed a “special virtual commodity.” Regulators argued that it lacked the authorized backing to operate as a forex. Therefore, it was seen as a possible outlet for laundering money.

In 2017, China took additional steps to forestall cash from flowing in another country illegally. In January of that yr, the PBoC launched an investigation towards crypto exchanges, specializing in foreign exchange administration and anti-money laundering.

The findings led to the choice to ban preliminary coin choices (ICOs) in September. Subsequently, the PBoC ordered capital raised by way of ICOs to be returned to traders.

It additionally banned monetary establishments and non-bank cost firms from offering providers that catered to token-based fundraising actions and issued a directive forcing crypto exchanges to close down voluntarily.

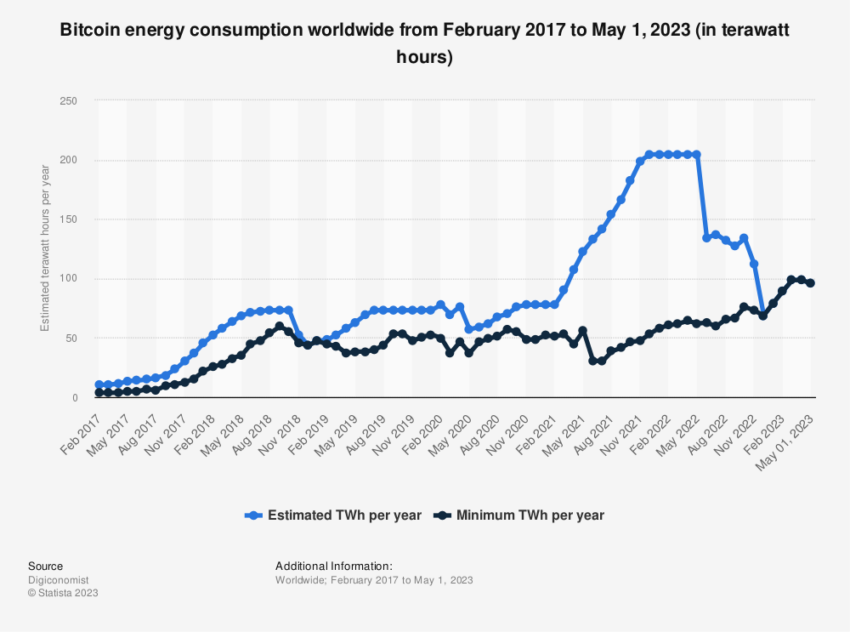

The crackdown continued within the following years, specializing in Bitcoin mining in 2019. The National Development and Reform Commission (NDRC) labeled it an “undesirable” business because of its environmental affect.

This classification prompted panic, as a major share of Bitcoin mining rigs are manufactured in China, and greater than half of the world’s Bitcoin mining energy was situated there.

In 2020, the federal government blocked over 100 international web sites providing crypto change providers. This collection of restrictions culminated in 2021, when China banned crypto buying and selling and mining altogether. It cited Bitcoin’s energy-intensive nature and risk to the nation’s environmental targets.

Bitcoin miners had been pressured to close down or transfer to different crypto-friendly nations, considerably impacting the worldwide crypto financial system.

A Green Light to Crypto Through Regulation

China now seems to be subtly shifting its stance on cryptocurrency. Hong Kong, a metropolis historically appearing as China’s sandbox, is forging forward with new rules suggesting that the crypto ban would possibly lastly be lifted.

Indeed, Hong Kong’s Monetary Authority (HKMA) is making substantial progress in crafting a regulatory framework for cryptos pegged to conventional monetary property, often called stablecoins.

HKMA’s announcement of a stablecoin regulatory regime by 2024 is a major growth. Especially for a area that has historically taken a opposite strategy to mainland China, the place cryptocurrency buying and selling stays unlawful.

Amid rising uncertainty and regulatory challenges within the US, the crypto group worldwide applauds Hong Kong’s steps towards coverage clarification for the brand new asset class.

“A lot of the Chinese capital is looking for smarter, safer ways to invest [and] being in Hong Kong naturally makes more sense than anywhere else,” mentioned Henry Liu, Chief Executive Officer at BTSE.

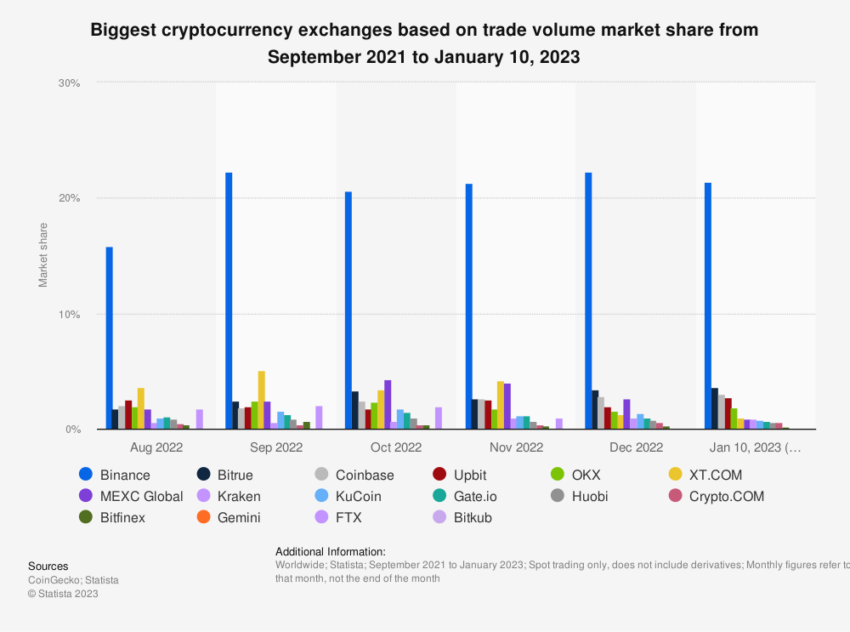

Recently, Hong Kong additionally launched a brand new crypto regulatory regime requiring exchanges to be licensed. It goals to pave the way in which for retail traders to commerce cryptocurrencies like Bitcoin and Ethereum. Even Hong Kong’s Legislative Council Member Johnny Ng invited crypto exchanges, together with Coinbase, to use and register within the area.

“I hereby offer an invitation to welcome all global virtual asset trading operators including Coinbase to come to HK for application of official trading platforms and further development plans,” mentioned Ng.

With the US Securities and Exchange Commission (SEC) cracking down on crypto exchanges, this invitation signifies Hong Kong’s readiness to embrace crypto companies aiming to serve retail clients within the nation.

Embracing Blockchain Technology and Web3

Furthermore, BOCI, a Chinese monetary establishment, just lately issued CNH 200 million in digitally structured notes. It marked its first tokenized safety issuance in Hong Kong.

The operation was originated by UBS and positioned to its shoppers in Asia Pacific. Subsequently, showcasing new steps in relevant legislation and blockchain sorts. It additionally signified the profitable introduction of regulated securities onto a public blockchain.

“We are driving the simplification of digital asset markets and products, for customers in Asia Pacific through the development of blockchain-based digital structured products… We are encouraged by the evolution of Hong Kong’s digital economy and are committed to promoting the digital transformation and innovative development of Hong Kong’s financial industry,” mentioned Ying Wang, Deputy Chief Executive Officer at BOC.

While Hong Kong’s welcoming stance and regulatory developments are laudable, the excitement round lifting China’s crypto ban will not be merely a by-product of those advances.

Beijing launched a white paper on Internet 3.0 Innovation and Development in mainland China. It included blockchain know-how as a key infrastructure, highlighting a possible change in China’s crypto stance.

Chaoyang District’s deliberate annual funding is not less than 100 million yuan. The objective of supporting the development of the Internet 3.0 industrial ecosystem additional factors to a extra crypto-friendly future.

Changes in Policy Point to Lifting the Ban on Crypto

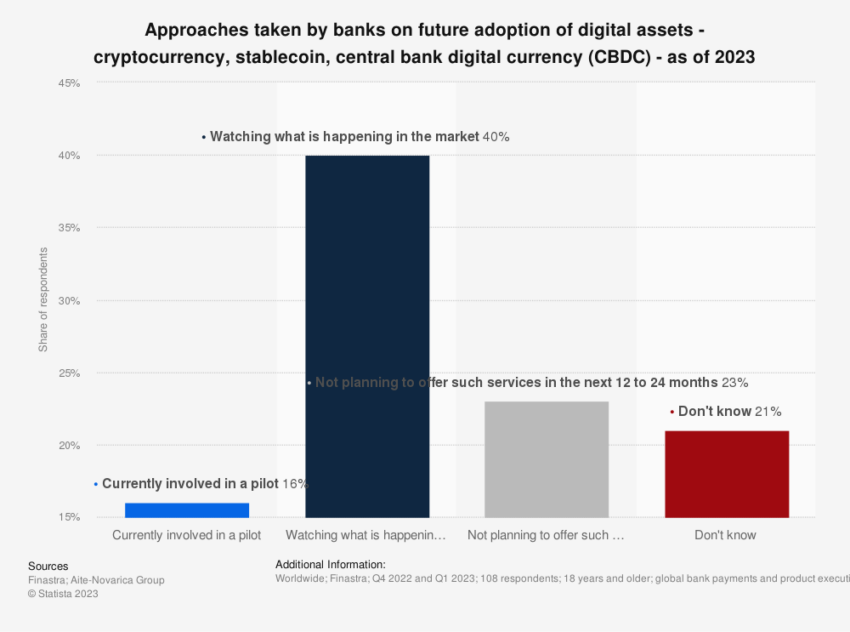

It is essential to do not forget that lifting a crypto ban as vital as China’s would require greater than only a regulatory shift.

It will entail a whole ecosystem overhaul, together with improved asset custody security measures, stringent cybersecurity requirements, and enhanced due diligence practices. The Hong Kong Securities and Futures Commission’s (SFC) plans to permit licensed platforms to serve retail traders below particular tips point out the meticulousness required.

These developments trace at a potential softening of China’s long-standing crypto ban. The highway to a full raise stays lengthy and complicated. Still, these are promising indicators for crypto lovers and traders alike.

The crypto market waits in anticipation of a possible game-changer from the East. Especially now that Hong Kong and mainland China proceed to refine their regulatory frameworks and embrace technological innovation.

Disclaimer

Following the Trust Project tips, this characteristic article presents opinions and views from business consultants or people. BeInCrypto is devoted to clear reporting, however the views expressed on this article don’t essentially replicate these of BeInCrypto or its workers. Readers ought to confirm info independently and seek the advice of with an expert earlier than making selections based mostly on this content material.