Since the inception of Bitcoin, the cryptocurrency market has quickly developed, giving rise to a bunch of distinctive digital property every purporting to supply one thing distinctive. Among them is XRP, a digital asset designed to clear up real-world monetary issues by its creators, Ripple Labs.

However, as the business grows, so too does the competitors. Banking titan JPMorgan Chase launched a brand new participant to the discipline, the JPM Coin, igniting a debate about its potential risk to cryptocurrencies like XRP.

How JPM Coin Compares to XRP

XRP has constantly differentiated itself by means of effectivity, cost-effectiveness, and real-time transaction capabilities. These primarily intention to enhance cross-border funds, notably inside the banking sector.

Unlike Bitcoin and Ethereum, XRP doesn’t depend on miners. It can attain consensus inside 4 seconds and acts as a mediator for forex alternate with out the want for intermediaries.

These attributes have led to partnerships with over 200 monetary establishments, serving to Ripple turn out to be certainly one of the main fintech unicorns worldwide.

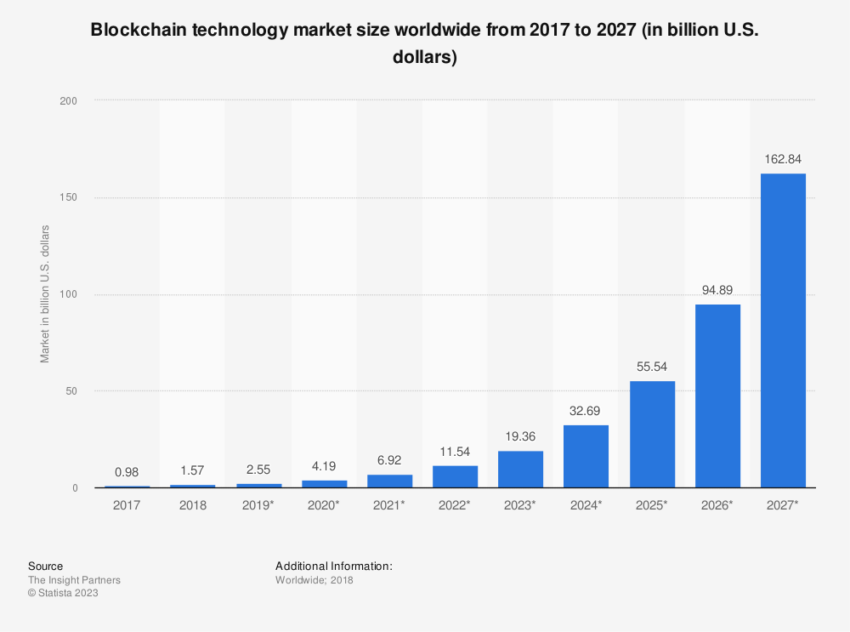

However, the introduction of JPM Coin, designed for instantaneous funds leveraging blockchain expertise, has sparked hypothesis about its potential affect on XRP. As a stablecoin, JPM Coin is pegged to the US greenback, providing stability essential for large-scale transactions inside JPMorgan’s wholesale funds enterprise.

While each XRP and JPM Coin intention to expedite and streamline monetary transactions, their designs and purposes considerably differ.

XRP was envisioned as a mediator between numerous fiat and cryptocurrencies. Meanwhile, JPM Coin is a closed community answer inside JPMorgan Chase’s ecosystem.

Ripple’s Regulatory Challenges Benefit JPMorgan

Despite its potential, XRP has confronted substantial challenges. These embody a lawsuit from the United States Securities and Exchange Commission (SEC) claiming that Ripple Labs illegally bought XRP as an unregistered safety. Its centralized nature makes it extra vulnerable to regulatory clampdowns than decentralized options like Bitcoin.

On the different hand, JPM Coin has a number of distinct benefits that make it a compelling prospect. Backed by JPMorgan’s huge deposit base, it gives a much less unstable and safer fee technique. It additionally facilitates sooner, extra versatile funds, aided by blockchain expertise.

Unlike XRP, which is topic to twin credit score dangers, JPM Coin solely includes JPMorgan as the creditor, decreasing potential dangers considerably.

The closed community design of JPM Coin might restrict its affect on the broader cryptocurrency market. The undeniable fact that it is at present not obtainable to particular person prospects however is restricted to JPMorgan’s wholesale funds enterprise additional restricts its sphere of affect.

Nonetheless, the latest introduction of euro-denominated funds for JPM Coin suggests a broader enlargement plan. The transfer alerts a larger potential to be used past simply greenback transactions. This may enhance its utilization and market attain.

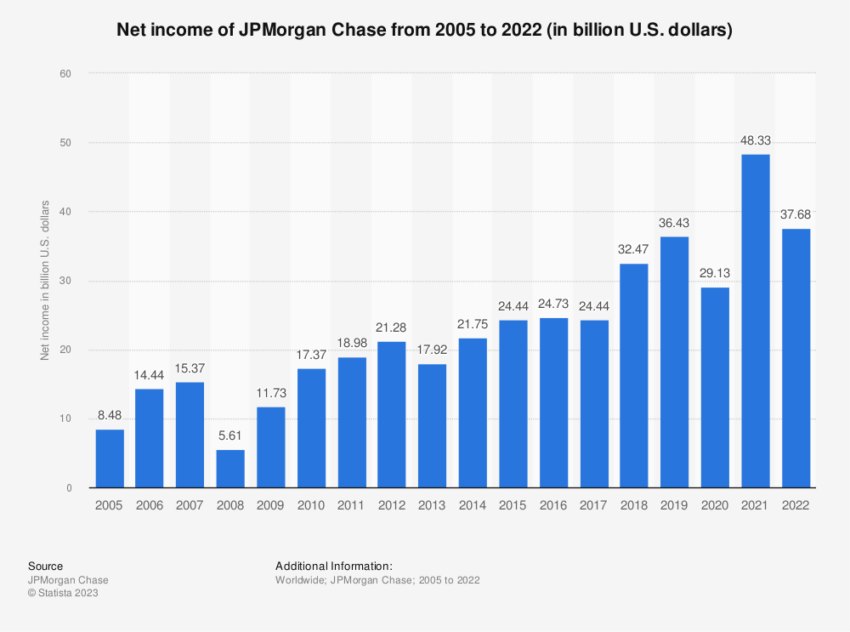

While JPM Coin accounts for less than a fraction of JPMorgan’s day by day $10 trillion funds, its development potential can’t be neglected. The capacity to execute funds sooner than conventional transactions could possibly be a game-changer in the business.

Is JPM Coin a Real Threat to XRP?

The reply is complicated. While JPM Coin definitely poses a problem in digital funds, it is not a direct competitor to XRP due to the completely different markets they cater to.

However, its emergence alerts a shift in conventional banking techniques in direction of blockchain options. This development that Ripple and different cryptocurrencies should carefully monitor may have important implications for his or her future.

JPM Coin, whereas a possible risk, is not the dying knell for XRP. However, it represents a development towards larger digitalization in conventional banking. As conventional monetary establishments more and more undertake blockchain expertise, it may threaten the market house of cryptocurrencies like XRP.

Although the speedy risk from JPM Coin may not be monumental, its ripple results may problem XRP.

Disclaimer

Following the Trust Project pointers, this function article presents opinions and views from business consultants or people. BeInCrypto is devoted to clear reporting, however the views expressed on this article don’t essentially replicate these of BeInCrypto or its workers. Readers ought to confirm info independently and seek the advice of with an expert earlier than making choices primarily based on this content material.