Between June 13 and June 27, or roughly two weeks, Tron’s stablecoin USDD dropped decrease than the $1 parity and slipped to a low of $0.928 per unit on June 19. During the previous seven days, USDD has managed to leap again to the $0.98 to $0.99 area whereas reaching $1 on July 3.

Tron’s USDD Stablecoin Climbs Back Above $0.98 per Unit

The stablecoin USDD, issued on high of the Tron community, noticed its worth slip beneath the everyday $1 parity it held previous to June 13. Prior to that day, the stablecoin’s chart regarded just like an electrocardiogram flatline holding a steady worth of round $0.994 to $1.

Between June thirteenth to the fifteenth, nevertheless, USDD’s fiat worth slipped to a low of $0.964 per unit. At that point, the Tron Reserve DAO collateralized the stablecoin with crypto property similar to tron (TRX) and usd coin (USDC). During that point, bitcoin (BTC) and plenty of different high crypto property slid considerably in worth.

On June 18, the crypto economic system shuddered and round 2 p.m. (ET), BTC hit a 2022 low at $17,593 per unit. The following day, Tron’s USDD hit the stablecoin’s all-time low at $0.928 per unit.

Eight days later, on June 27, USDD managed to get again to the $0.98 to $0.99 vary, and it’s been buying and selling for that worth ever since, with one temporary spike to $1 per unit on July 3. While the stablecoin had a two-week run beneath the conventional fee, the Tron Reserve DAO continued so as to add extra collateral to the venture.

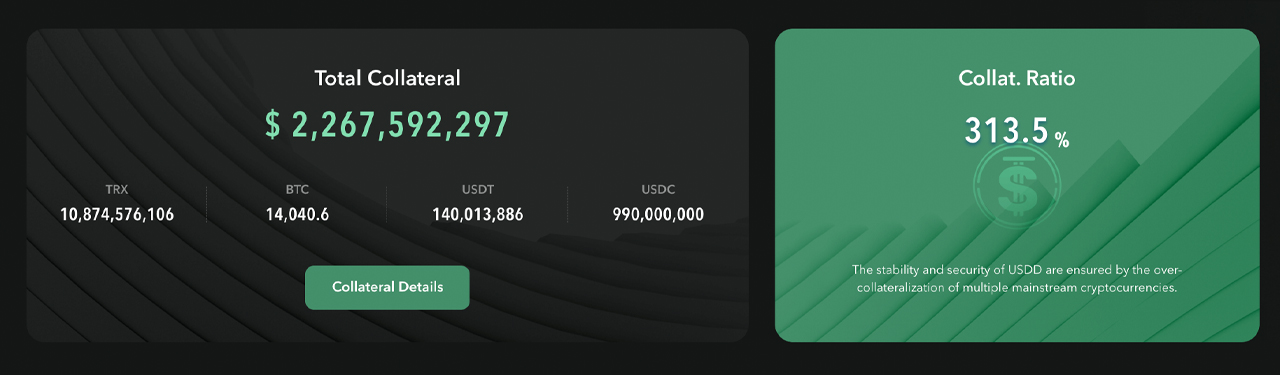

At the time of writing, the venture’s reserve web page notes that there’s 723.32 million USDD in circulation. The internet web page particulars that USDD is overcollateralized by 313.5% at the time of writing, with 4 completely different crypto property backing the venture.

Assets embrace 10.874 billion tron, 14,040.6 bitcoin, 140 million tether, and 990 million usd coin. When USDD noticed a cheaper price worth than common for 2 weeks in the course of the crypto market downturn, a few different stablecoins additionally dropped to decrease values than common.

Top 9 Stablecoins by Market Cap Remain Stable

Bitcoin.com News reported on Abracadabra’s stablecoin MIM slipping to $0.91 and the Waves stablecoin neutrino usd (USDN) sliding to $0.931 per unit. While USDD has held a steady worth vary over the past week, USDN is exchanging fingers for $0.987 whereas MIM is swapping for $0.993.

The Tron Reserve DAO has continued to bolster the stablecoin’s backing with reserves and it’s been buying again USDD with property as nicely. Stablecoins have all seen situations the place the worth of the coin is beneath the anticipated $1 parity. However, stablecoins like nubits, empty set greenback, titan, and foundation money have all failed and the latest terrausd (UST) implosion has precipitated a whole lot of concern and worries about the potential for extra stablecoin failures.

The concern has been directed at a few of the largest stablecoins within the trade and most of the smaller stablecoin capitalizations with much less liquidity. Meanwhile, the highest 9 stablecoins by way of market valuation, have been steady this week buying and selling for $0.98 to $1 per token.

What do you consider USDD climbing again to the $0.98 to $0.99 area? Let us know what you consider this topic within the feedback part beneath.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational functions solely. It just isn’t a direct provide or solicitation of an provide to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, instantly or not directly, for any harm or loss precipitated or alleged to be attributable to or in reference to using or reliance on any content material, items or providers talked about on this article.