In an period of wavering religion in financial management, the American public’s belief in Jerome Powell, the Federal Reserve’s Chair, is declining. Is this merely a symptom of a unstable financial system or a extra profound shift in public sentiment towards Bitcoin?

As central financial institution methods come beneath scrutiny, the potential for different monetary techniques, such as Bitcoin, is drawing elevated consideration. Could this digital foreign money reshape the nation’s monetary panorama, offering stability amidst uncertainty?

The Declining Trust in Jerome Powell: An Unprecedented Shift

In a putting twist, the American public’s confidence in Jerome Powell is quickly eroding. Gallup’s latest survey reveals a document low 36% of Americans imagine in Powell’s financial acumen.

This determine represents the nadir of Powell’s six-year reign. It is the bottom confidence score Gallup has recorded for any Federal Reserve Chair since its knowledge monitoring started with Alan Greenspan in 2001.

Interestingly, 28% of Americans profess virtually no confidence in the Republican Federal Reserve Chair, initially nominated by former President Donald Trump.

The significance of this improvement can’t be understated. The Federal Reserve, usually envisioned as an unshakeable bastion of knowledge, depends closely on public belief for its operational effectiveness. The establishment’s success hinges on its perceived dependability and talent to form coverage successfully, free from political interference.

The energy of perception in the Federal Reserve’s commitments is substantial. Should Jerome Powell pledge to curtail the hovering inflation charges, as an illustration, the American public’s religion in his promise can provoke behavioral modifications, successfully setting a self-fulfilling prophecy in movement.

Recent turbulence in the banking sector solely amplifies the necessity for such unwavering belief. The Federal Reserve wants to influence the general public of the soundness of regional banks. The future well-being of the financial system might cling in the stability.

However, the general public’s perceptions and actuality usually diverge, and the Federal Reserve shouldn’t be proof against the unpredictable swings of financial sentiment. The rising unease amongst Americans in regards to the financial system is more and more mirrored in their views of key authorities officers liable for financial coverage.

The Federal Reserve’s Battle with Inflation: A Slow and Steady Approach

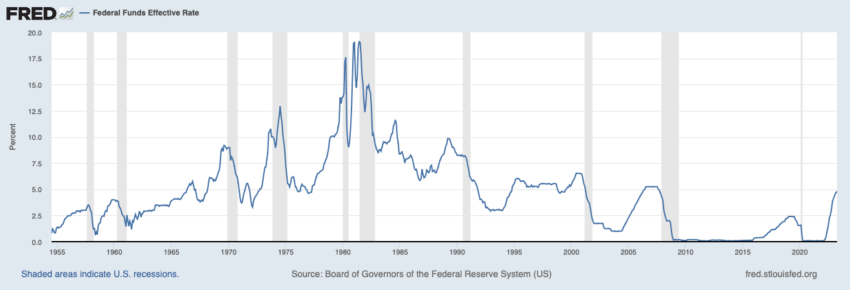

The Federal Reserve has tried to stem inflation by implementing a collection of rate of interest hikes in simply over a yr. This aggressive motion has taken a toll on the financial system. Despite some easing of inflation charges, they continue to be considerably above the Federal Reserve’s 2% goal degree.

The American public’s consciousness of inflation, which is usually unwelcome, is a transparent indicator of the Federal Reserve’s challenges. If the general public loses religion in Powell’s messaging, it’d herald extra vital issues.

Given his function, the general public’s skepticism of Powell could also be par for the course. But apparently, they appear to imagine that he’ll fulfill his guarantees.

For occasion, the Federal Reserve has hinted at a possible pause in price hikes on the upcoming assembly. Market predictions align with this forecast, displaying a 90% probability of it transpiring.

However, to maintain public confidence, the Federal Reserve should convincingly show its capacity to realize its 2% inflation goal earlier than it eases its coverage. This means that rates of interest could stay excessive, probably rising additional if inflation doesn’t fall into line.

The credibility of the Federal Reserve will face one other vital check quickly. Essentially how the American public perceives its regulation of the banking business. This brings one to a vital query: might Bitcoin, the decentralized crypto, be the reply?

Bitcoin: The Beacon of Hope in a Trust-Deficient Economy?

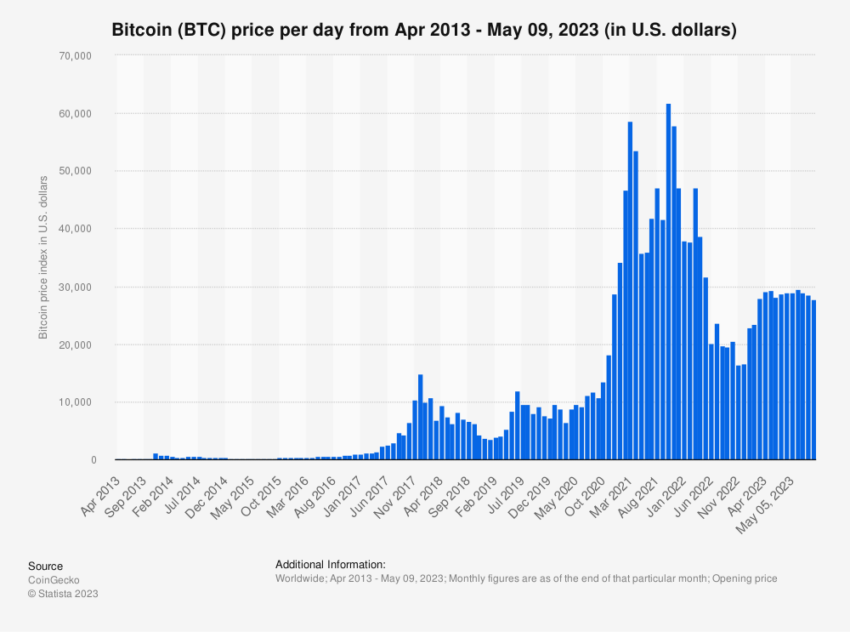

Bitcoin, with its peer-to-peer transaction system, presents a possible different. As the general public’s belief in centralized establishments dwindles, the enchantment of a decentralized, clear, and tamper-proof system will increase.

The main digital foreign money gives an alternate monetary panorama free from the affect of particular person personalities and coverage selections. As such, it’d simply be the beacon of hope that America wants, reshaping the nation’s monetary panorama and restoring belief in a time of uncertainty.

Bitcoin might supply an alternate answer that doesn’t depend on the trustworthiness of a single particular person or establishment however operates on a clear, immutable ledger. With the facility to validate transactions and retailer worth, Bitcoin might turn into a pivotal a part of a extra decentralized, resilient monetary system.

In these difficult occasions, the Federal Reserve’s mission to average inflation appears gradual and regular. As annual inflation cooled final month to its lowest degree since April 2021, the query stays whether or not the Federal Reserve’s strategy shall be efficient in the long term.

Even although the Consumer Price Index (CPI) has regularly decelerated, the inflation price stays uncomfortably excessive. This has led to hypothesis on whether or not the Federal Reserve may pause its rate of interest hikes.

While the reply lies in the unsure future, the potential for Bitcoin as a secure haven is changing into more and more believable. Bitcoin’s decentralized nature makes it proof against the whims of coverage modifications, making it a extra steady retailer of worth.

As belief in conventional establishments just like the Federal Reserve continues to erode, the attract of revolutionary, decentralized alternate options such as Bitcoin turns into more and more irresistible.

Disclaimer

Following the Trust Project pointers, this function article presents opinions and views from business specialists or people. BeInCrypto is devoted to clear reporting, however the views expressed in this text don’t essentially mirror these of BeInCrypto or its employees. Readers ought to confirm data independently and seek the advice of with knowledgeable earlier than making selections primarily based on this content material.