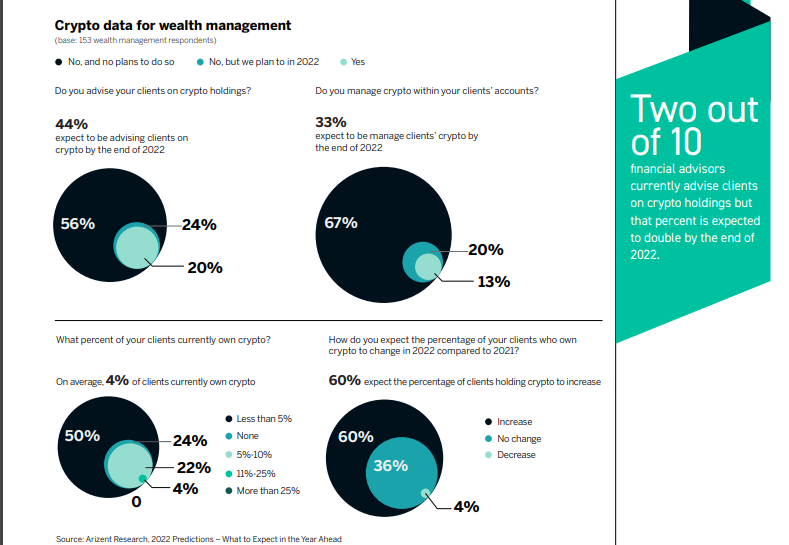

According to the searchings for of a brand-new study, the number of financial advisors presently counseling crypto holding clients is anticipated to double from the present 2 out of 10 or 20% to 44% by completion of 2022.

Only Four Percent Expect the Number of Crypto Holding Clients to Decrease

The number of financial advisors in the United States that presently advice their clients on crypto holdings is anticipated to double in 2022, a brand-new research has actually discovered. According to the research, which checked riches administration specialists based in the U.S., this forecasted surge remains in the number of advisors to 44% remains in tandem with their assumption that even more clients (concerning 33%) will likely come to be owners of crypto by completion of 2022.

As revealed by the information that was acquired from the 153 participants that took part in Arizent Research’s 2022 Prediction study, concerning 60% of financial advisors expect to see the number of crypto holding clients increase. And with just 4 percent of the participants anticipating to see this number decrease, the research searchings for recommend clients’ need for cryptocurrencies is not subsiding.

Other Competitive Threats

Rather, the searchings for reveal that cryptocurrencies, which are currently extensively covered by the financial press, “are [now] a big theme in investing circles” However, according to the research’s record, this development in cryptocurrency’s appeal has actually included to financial institutions’ listing of stresses that currently consist of the risk postured fintech and also repayments companies in addition to the mooted U.S. electronic money. The research record discusses:

Only 4 in 10 financial institutions see an increase in their financial investment in conventional bank card with commitment and also incentives functions within the following 3 years. That might be a representation of various other affordable risks to bank card, such as electronic settlement options like PayPal and also Venmo and also efforts by the Federal Reserve.

This remains in enhancement to one in 4 financial institutions that sees a genuine opportunity of an affordable risk postured by customers banking in the U.S. Federal Reserve efforts “such as FedNow real-time payments, an alternative to traditional wires and ACH transfers” The prospective production of a ‘digital dollar’ money is likewise viewed as one more feasible affordable risk.

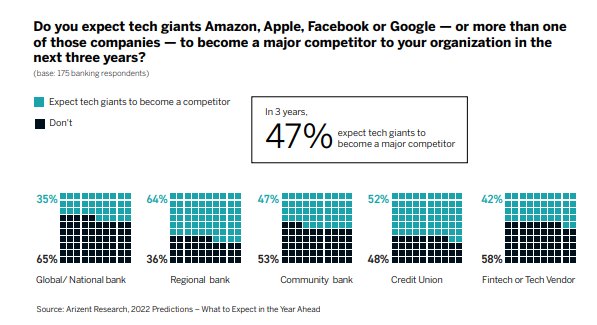

Meanwhile, the research likewise discovered the opportunity of large technology companies muscling their means right into the financial solutions sector to be a vital fear for financial institutions and also insurance providers. As displayed in the information, concerning “six in ten digital insurers worry that those forays are a competitive threat.”

On the various other hand, virtually fifty percent of all financial institutions, “or 47%, expect Big Tech to become a major competitor within three years.” The searchings for likewise reveal local financial institutions to be one of the most anxious with 64%.

What are your ideas on this tale? Tell us what you assume in the remarks area listed below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This post is for informative objectives just. It is not a straight deal or solicitation of a deal to purchase or market, or a referral or recommendation of any kind of items, solutions, or business. Bitcoin.com does not give financial investment, tax obligation, lawful, or audit suggestions. Neither the firm neither the writer is liable, straight or indirectly, for any kind of damages or loss created or declared to be created by or about the usage of or dependence on any kind of web content, items or solutions discussed in this post.