In a matter of days, traders’ view on the outlook for the Bitcoin worth has flipped from being bearish to bullish, as represented by a shift in choices market pricing. The flip in investor sentiment comes as the Bitcoin worth surges above the $28,000 stage for the primary time since early final June, taking good points since earlier month-to-month lows to over 44%.

Yearly good points are actually nearer to 70%, with Bitcoin pumping amid 1) elevated demand for property deemed as a secure haven given troubles within the international banking system and a couple of) elevated bets that US Federal Reserve received’t have interaction in a lot additional tightening. Indeed, within the week forward, the Fed’s coverage assembly shall be a key occasion, with traders cut up over whether or not the financial institution will ship one last 25 bps fee hike.

Options Markets Flip Bullish

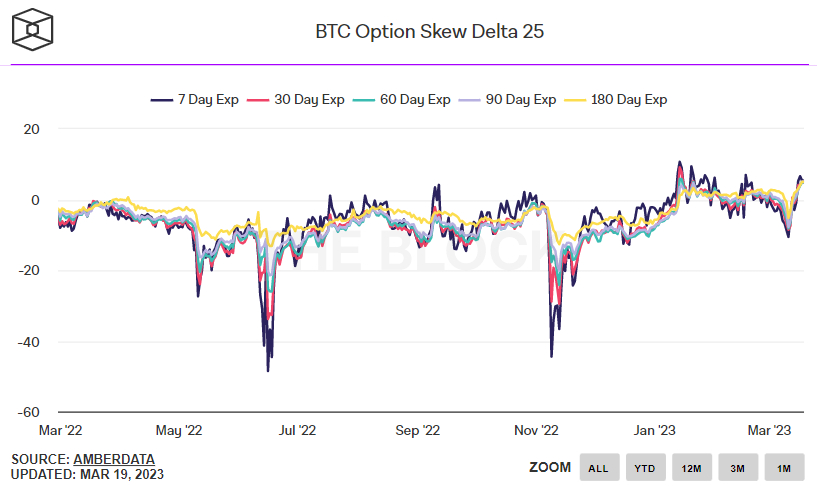

When Bitcoin dipped underneath $20,000 for the primary time in two months final week, the outlook for the BTC worth in response to the 25% delta skew of Bitcoin choices expiring in 7, 30, 60, 90 and 180 days fell to their lowest ranges of the yr of between -5 to -10.

However, the aggressive worth restoration has seen the 25% delta skew of Bitcoin choices expiring in 7, 30, 60, 90 and 180 days get better quickly into bullish territory, with all shut to five. For the 7-day 25% delta skew, that’s its highest stage since mid-February. For the 30, 60 and 90-day skews, that’s their highest stage since mid-January. Finally, for the 180-day skew, that’s its highest stage since November 2021.

The 25% delta choices skew is a popularly monitored proxy for the diploma to which buying and selling desks are over or undercharging for upside or draw back safety by way of the put and name choices they’re promoting to traders. Put choices give an investor the best however not the duty to promote an asset at a predetermined worth, whereas a name choice provides an investor the best however not the duty to purchase an asset at a predetermined worth.

A 25% delta choices skew above 0 means that desks are charging extra for equal name choices versus places. This implies there may be stronger demand for calls versus places, which may be interpreted as a bullish signal as traders are extra wanting to safe safety towards (or wager on) an increase in costs.

Bitcoin choices markets are thus sending a message that traders are positioning for additional good points. And that is sensible within the context of latest strikes.

Where Next for the BTC Price?

With Bitcoin having now seemingly cleared resistance within the type of the late May 2022 lows within the $28,000 space, the door is now open to a swift check of the psychologically essential $30,000 stage after which the early June 2022 highs within the $32,500 space. Indeed, there isn’t a lot by means of any resistance to stop such a rally.

Fundamentals appear prone to proceed to help Bitcoin upside. If this week’s Fed assembly is dovish, related risk-on flows and easing monetary situations ought to help the Bitcoin worth. If the Fed isn’t as dovish as the market hopes, this might trigger a short-term worth wobble, however would seemingly end in additional US financial institution sector strains, which may improve demand for Bitcoin as a safe-haven different.

All the whereas, on-chain developments are trying constructive. Core on-chain metrics just like the variety of non-zero steadiness wallets, the variety of every day transactions, the variety of every day energetic addresses and the speed of latest tackle creation are all trending in the best course. Alternative indicators such as these tracked in Glassnode’s “Recovering from a Bitcoin Bear” dashboard are (largely) flashing a bullish sign as effectively.