Wall Street suffered Monday morning as the most important U.S. inventory indexes dropped additional, constructing on losses gathered final week. Reports point out that traders are involved concerning the upcoming Federal Reserve price hikes and China’s current Covid-19 outbreak. As equities floundered on Monday, the crypto financial system slid underneath the $2 trillion mark and gold costs dropped 1.6% in opposition to the U.S. greenback in the course of the previous 24 hours. However, after Elon Musk revealed he acquired Twitter at 2:50 p.m. (ET), each equities and crypto markets rebounded a nice deal following the announcement.

Global Markets Shake Over Fears of Covid-19 Related Supply Chain Issues and the Possibility of Aggressive Rate Hikes

Four days in the past, Jerome Powell, the present U.S. Federal Reserve chair, defined at an International Monetary Fund (IMF) panel dialogue on April 21, that the U.S. central financial institution might have to maneuver “more quickly” relating to financial institution price hikes. Powell additional famous that the U.S. central financial institution might implement a 50 basis-point price hike on the subsequent Fed assembly. The hawkish feedback from Powell have spooked traders and U.S. inventory indexes took losses earlier than the weekend began final week.

On Monday, Wall Street continued to endure because the Dow Jones Industrial Average, NYSE Composite, and the S&P 500 all noticed losses. At 10 a.m. (ET), the Dow shed 415.23 factors and by the afternoon, it recovered a little greater than half of the losses again. The blame is at present being positioned on the Federal Reserve’s upcoming price hikes, and China’s Covid-19 lockdowns. The chief fairness strategist at MAI Capital Management, Christopher Grisanti, advised Reuters that China’s present lockdowns have precipitated concern of doable provide chain issues.

“China lockdowns are getting worse. It slows general economic growth and also creates supply chain issues that will continue to make inflation bad and lower earnings growth in the United States,” Grisanti stated. “I don’t think we’ve seen the bottom yet. We haven’t had that big sell-off yet where we have huge volumes,” the strategist added.

Gold and Crypto Markets Suffer, Portfolio Manager Says ‘Markets Are Struggling’

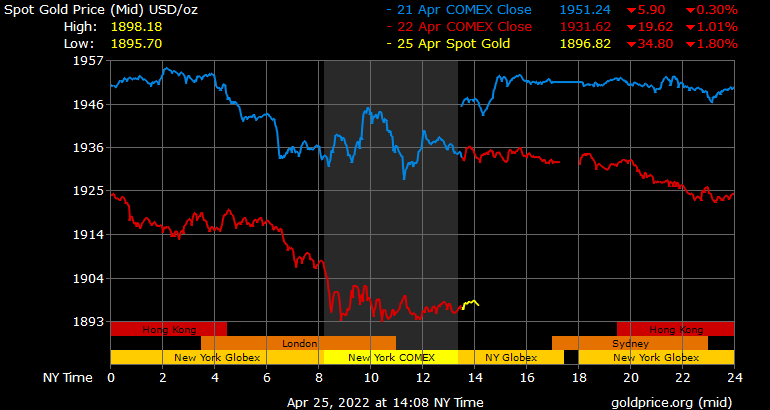

Gold and cryptocurrencies have additionally seen a downward pattern in current instances. The crypto financial system has shed billions during the last week, slipping again under the $2 trillion mark. Quite a lot of the highest ten digital belongings noticed losses between 2 and 10% over the past seven days. Furthermore, the worth of 1 ounce of high quality gold has seen some proportion losses over the past 24 hours.

One ounce of high quality gold has shed 1.6% in worth during the last day, and one ounce of high quality silver has misplaced 2.04%. Gold costs during the last 30 days have been stagnant too, and one-month stats present an oz of gold’s USD worth elevated by a slight 0.39%. Silver, alternatively, dropped greater than 3% over the past 30 days. The valuable metals’ decline in worth can be being blamed on China’s Covid-19 outbreak and present U.S. Treasury yields could possibly be pulling gold traders away.

Steven Violin, a portfolio supervisor at F.L.Putnam Investment Management Co. advised Marketwatch in an interview on April 23, that traders are combating “very strong forces.” Violin remarked that it’s very seemingly that no person can predict what’s going to occur with the financial system. “The tremendous economic momentum from the recovery from the pandemic is being met with a very rapid shift in monetary policy,” Violin stated. “Markets are struggling, as we all are, to understand how that’s going to play out. I’m not sure anyone really knows the answer.”

U.S. Equities and Cryptocurrencies Erase the Day’s Losses After Musk Buys Twitter

Despite the inventory market downturn and the current crypto financial system losses, each equities and crypto costs rebounded after Twitter introduced that Tesla’s Elon Musk bought Twitter. The whole crypto financial system jumped from $1.93 trillion to $1.96 trillion after the announcment. After dropping under the $40K mark, BTC as soon as once more jumped again above the $40K area.

I hope that even my worst critics stay on Twitter, as a result of that’s what free speech means

— Elon Musk (@elonmusk) April 25, 2022

Major U.S. inventory indexes recovered from the morning losses in addition to NYSE, the Dow, S&P 500, and Nasdaq erased a lot of the day’s losses. As the buying and selling day on Wall Street neared the closing bell, the most important indexes flashed from purple to inexperienced. After the corporate was acquired by Musk, Twitter’s present CEO Parag Agrawal stated: “Twitter has a purpose and relevance that impacts the entire world. Deeply proud of our teams and inspired by the work that has never been more important.” It appears inventory traders and crypto market contributors like the truth that Musk bought the social media agency.

What do you concentrate on world markets immediately? Do you count on markets to proceed sliding or do you assume a rebound is coming within the close to future? Let us know what you concentrate on this topic and the financial system within the feedback part under.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational functions solely. It will not be a direct provide or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, straight or not directly, for any harm or loss precipitated or alleged to be precipitated by or in reference to using or reliance on any content material, items or companies talked about on this article.