In right this moment’s evaluation, BeInCrypto seems to be on the Wyckoff schematics, which might clarify the present accumulation section of the Bitcoin (BTC) worth. This sample, recognized from conventional markets, has already been used to accurately determine the height of the cryptocurrency bull market in 2021.

However, if Wyckoff accumulation is to play out in keeping with its primary sample, Bitcoin mustn’t fall under the Nov. low at $15,476. Moreover, within the close to future, the biggest cryptocurrency must reclaim assist at $18,000 after which transfer in the direction of $22,500.

What Does Wyckoff Schematics Mean?

Richard Wyckoff (1873-1934) proposed his basic analytical sample. He was one of many pioneers of contemporary technical evaluation, founding father of the Magazine of Wall Street and a dealer in conventional inventory markets. It was within the evaluation of those markets that the diagram turned in style.

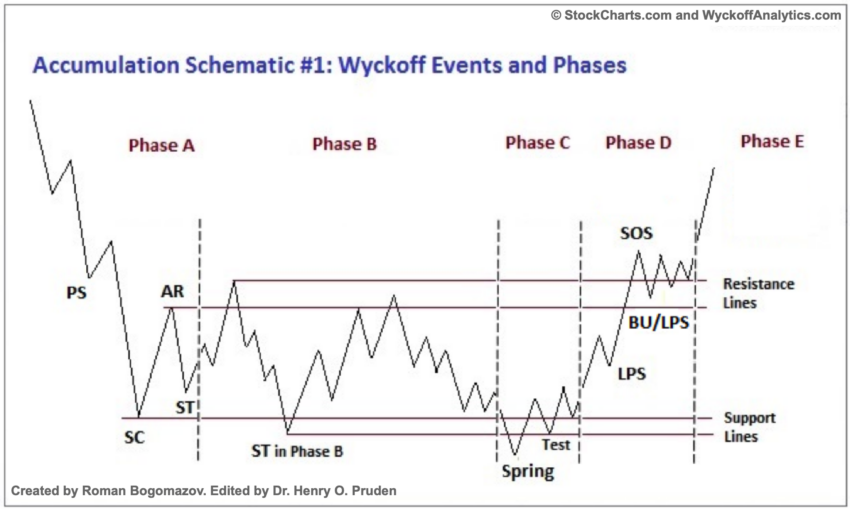

The construction of a typical Wyckoff schematics consists of a sequence of sharp up and down worth actions that kind a sort of prolonged distribution or accumulation. This sample typically happens after long-term declines or will increase in a given asset. One of the tops or bottoms of the sample is the height or backside for the chosen interval of worth motion. Once it’s reached, the pattern reverses and the decline or improve accelerates.

In order to make good use of the Wyckoff schematics, one should first acknowledge it accurately. For this, buying and selling ranges, volatility of the asset and buying and selling quantity are used. Based on this, acceptable shopping for or promoting choices are made. The most important precept right here is gradual promoting throughout the distribution interval and gradual shopping for throughout the accumulation interval. Roughly talking, the 2 durations are mirror photos of one another.

Distribution is a sideways market pattern that takes place after a protracted uptrend. It is a section by which good merchants and massive institutional gamers attempt to promote their positions with out pushing the worth down an excessive amount of.

Accumulation is the precise reverse of distribution. Accumulation is a sideways market pattern that happens after an prolonged downtrend. It is a section by which good merchants and massive institutional gamers attempt to purchase positions with out transferring the worth up an excessive amount of.

Wyckoff accumulation in 6 phases

The Wyckoff schematics gives detailed steerage for figuring out durations of accumulation and distribution. These might be decided based mostly on sure patterns that seem inside these vary sure tendencies. In this manner, the complete schematics might be divided into six phases. While they’re analogous for each durations under we current how Wyckoff accumulation proceeds:

1. Preliminary Support (PS)

A preliminary assist is a stage that types after a big drop in market costs. Institutions and merchants attempt to take lengthy positions after a robust decline. It can be troublesome for the market to fall under this stage on account of sturdy shopping for strain.

2 Selling Climax (SC)

A promoting climax is characterised by a pointy decline under preliminary assist. Panic promoting is absorbed by massive institutional gamers or good merchants. It typically goes hand in hand with FUD and adverse market information.

3 Automatic Rally (AR)

An computerized rally is an upward motion that happens after a promoting climax is reached. Prices rise, solely to then fall rapidly after reaching a neighborhood peak. The highest level of those will increase typically coincides with the extent of preliminary assist (1), which now acts as resistance. After this section, dealer exercise decreases and bearish sentiment turns into weaker.

4 Secondary Test (ST)

A secondary take a look at happens after an computerized rally. It signifies that the worth of an asset has reached a market backside. It is widespread for a number of secondary exams to happen because the market exams the power of consumers.

A Spring into Life

5 Spring

A spring is a robust and definitive shock that always occurs throughout the accumulation section. Prices will typically fall under SC and ST ranges. The lack of the buying and selling vary is short-lived. The worth rapidly returns to verify a false breakout. Large gamers mislead retailer, and to buy property at a cheaper price. Wyckoff accumulation is confirmed on this section.

6 Sign of Strength (SOS)

A sign of power takes place after the spring and signifies the return of bullish sentiment to the market. In this section, the worth recovers the world of preliminary assist of the complete Wyckoff accumulation. Sometimes its restoration is preceded by the Last Point of Support (LPS) section, which is a retest of earlier resistance. The signal of power section confirms the benefit of consumers and the beginning of an upward pattern.

Wyckoff accumulation on the Bitcoin chart

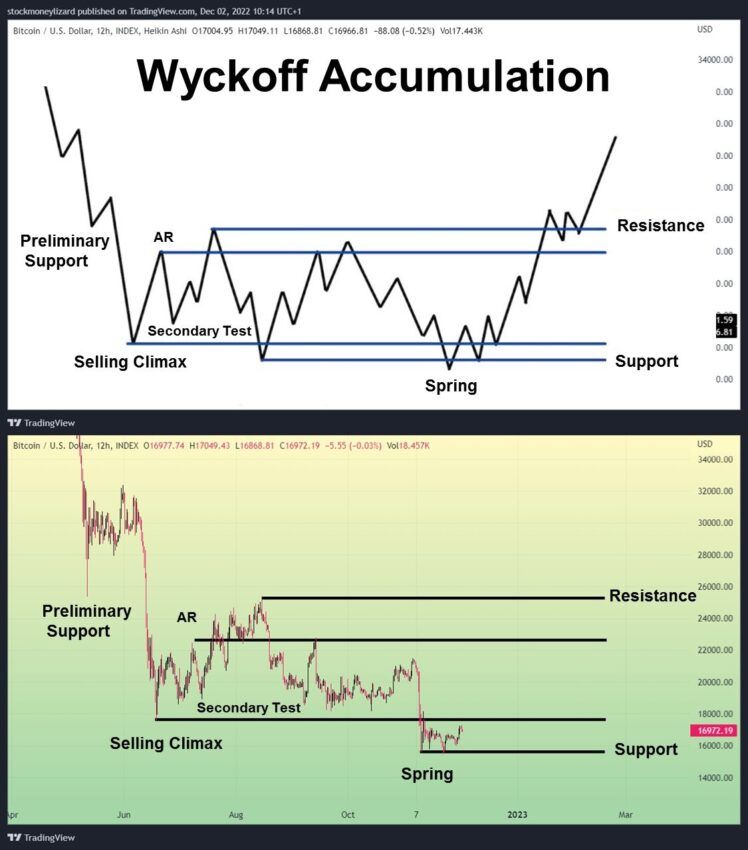

Popular cryptocurrency market analyst @StockmoneyL just lately prompt that Bitcoin might at present be pursuing successive phases of Wyckoff accumulation. In his tweet, he compares the each day BTC worth from mid-May 2022 to now with the Wyckoff sample.

According to this comparability, Bitcoin has already handed by the primary 4 phases of Wyckoff accumulation and skilled a promoting climax (SC) within the $18,000 space. Currently, it’s on the fifth section and on the similar time on the lowest level of accumulation, the spring section.

If that is certainly the case, the BTC worth ought to now not drop under the underside at $15,476 on November 21. Moreover, it ought to rapidly regain the SC space and ensure it as assist. We can conclude that the present section (spring) was solely a false breakout, and the worth managed to return to the buildup vary.

Going ahead, the BTC worth must try and regain the $22,500 space – the height of the AR section reached in July and retested in mid-Sept. On the opposite hand, the ultimate affirmation of the top of Wyckoff accumulation can be the restoration of the PS stage close to $26,000, which is the May low resistance.

A Bitcoin drop under the present backside at $15,476 would result in rejection of this model of Wyckoff accumulation. Similarly, a too-long keep of the BTC worth under the $18,000 stage would additionally falsify this sample.

For BeInCrypto’s newest crypto market evaluation, click on right here.

Disclaimer

BeinCrypto strives to offer correct and up-to-date info, nevertheless it won’t be accountable for any lacking info or inaccurate info. You comply and perceive that you must use any of this info at your personal danger. Cryptocurrencies are extremely unstable monetary property, so analysis and make your personal monetary choices.