Key Takeaways

The variety of day-to-day customers on Polygon is expanding quickly, with the Layer 1 scaling service lately going beyond Ethereum in the variety of day-to-day purchases.

Ethereum-indigenous methods such as Aave, SushiSwap, as well as Curve blazed a trail for Ethereum customers to move to the network.

Polygon is an Ethereum scaling service as well as remains in straight competitors with Binance Smart Chain.

Share this post

Polygon uses a comparable yield farming experience to Ethereum mainnet at a portion of the expense. Key metrics reveal that DeFi power customers are beginning to move to the network.

Low-Cost DeFi on Polygon

High gas charges are prices routine financiers out of DeFi on Ethereum. As the cost of ETH has actually increased, gas charges have actually likewise risen, casting uncertainties over the opportunity of a 2nd DeFi summer season.

Ethereum’s appeal has actually aided drive gas costs to document highs despite having companies like Flashbots functioning to lower blockchain blockage. Some customers have actually transformed to Binance Smart Chain, though that network has actually dealt with a selection of problems such as hacks as well as flash financing strikes.

In the look for reduced charges as well as rapid purchases, numerous yield farmers have actually transformed to Polygon, the Ethereum scaling service that’s occasionally called a “commit chain.” Polygon utilizes a Proof-of-Stake agreement formula, as well as purchases on the network expense portions of a cent.

The development in the variety of day-to-day energetic addresses has actually been come with by an outstanding increase in the cost of Polygon’s indigenous token, MATIC. Over the last thirty days, the token cost has actually boosted by greater than 300%, according to CoinGecko. The variety of purchases on Polygon likewise went beyond Ethereum for the very first time on May 2, with leading exchange Quickswap audit for the majority of the quantity.

Let’s go into some @0xPolygon information on @nansen_ai (presently in alpha). Looks like its turned eth based upon variety of purchases on May second. pic.twitter.com/pzJDdFCtfV

— Akshay (@aioeth) May 7, 2021

According to Nansen, just 0.09% of Ethereum addresses have actually communicated with Polygon, which has actually implied there are abundant yield farming chances for those that have actually begun utilizing the network. The possibility to gain easy returns has actually boosted as even more methods have actually released on Polygon.

While applications like Quickswap are Polygon-indigenous, passion in the Layer 1 scaling service expanded when developed DeFi methods established variations of their applications on Polygon. Aave, Curve, as well as SushiSwap have all signed up with the environment this year, with favorable outcomes.

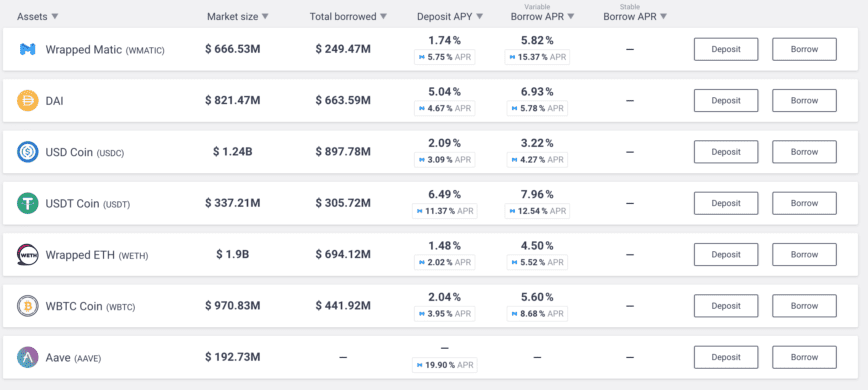

Even after the launch of Aave v2 as well as a prominent liquidity mining program on Ethereum, Aave’s Polygon market dimension has actually currently gotten to $6 billion. To assist the marketplace expand, Polygon has actually dispersed MATIC benefits for loan providers as well as consumers. The need for affordable DeFi, very easy gain access to to funding, as well as the MATIC benefits dispersed to loan providers as well as consumers have all aided bring in liquidity.

Lenders can presently gain up to 18% loaning USDT on Aave. Interestingly, customers can likewise obtain USDT at a price of 8% annually however gain 12.5% in MATIC benefits, causing a web gain.

Yield Farming on Polygon

DeFi customers presently have numerous alternatives for gaining high yield on crypto possessions on Polygon. The initially opportunity is to offer liquidity on Quickswap, one of the most prominent exchange on Polygon. With reduced charges as well as gas costs, Quickswap’s quantity is high as well as causes high compensations for liquidity companies (LPs). In enhancement, LPs can obtain fast benefits on specific swimming pools, better enhancing APYs. These benefits presently vary from 30% on stablecoin sets to 200% when the trading set consists of QUICK. SushiSwap as well as Curve are likewise providing MATIC benefits in addition to charges for their LPs.

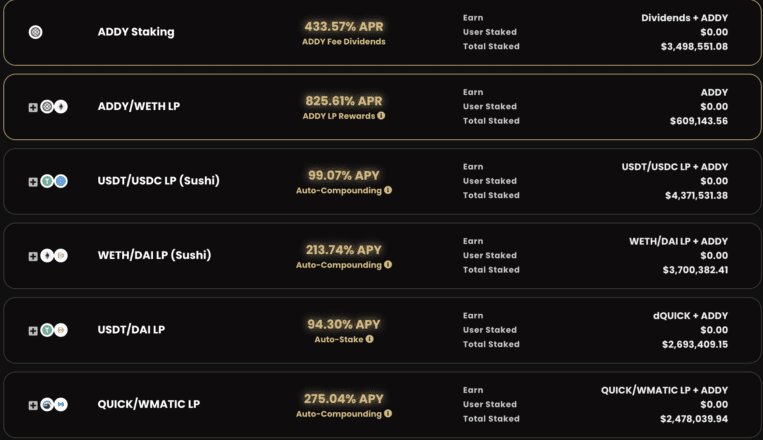

Users can likewise pick to delegate their LP symbols (symbols got when offering liquidity to a trading set) to yield collectors like Yearn.Finance on Ethereum. These yield collectors assist reinvest earnings in the exact same swimming pools, enhancing the returns of their customers. Some systems such as Adamant Finance have actually likewise released their very own administration token as a more motivation, driving APYs also greater. As an outcome, offering LP symbols for Sushi’s USDT/USDC swimming pool is presently gaining a 99% APY, consisting of ADDY symbols.

Classic yield ranches are back also, one of the most prominent until now being Polywhale. Users can bet their cryptocurrencies in Polywhale’s swimming pools for its indigenous token KRILL. When customers transfer their crypto possessions, a section of their down payment is utilized to redeemed KRILL from the marketplace. Users can presently gain up to 80% APY by betting MATIC, harvest the KRILL benefits, as well as down payment them in their very own swimming pool for up to 2,500% APY.

It’s crucial to note that such ranches are very speculative, as well as the cost of symbols like KRILL can be incredibly unpredictable. For numerous customers, the mix of danger as well as significant returns remembers the summer season of 2020 on Ethereum. If the enjoyment around DeFi yield farming returns this summer season, it might well get on Polygon.

Disclaimer: The writer held BTC, ETH, as well as numerous various other cryptocurrencies at the time of creating.

Share this post

The info on or accessed via this site is gotten from independent resources our team believe to be precise as well as reputable, however Decentral Media, Inc. makes no depiction or guarantee as to the timeliness, efficiency, or precision of any type of info on or accessed via this site. Decentral Media, Inc. is not a financial investment consultant. We do not provide individualized financial investment recommendations or various other monetary recommendations. The info on this site is subject to adjustment without notification. Some or every one of the info on this site might come to be out-of-date, or it might be or come to be insufficient or unreliable. We may, however are not obliged to, upgrade any type of out-of-date, insufficient, or unreliable info.

You must never ever make a financial investment choice on an ICO, IEO, or various other financial investment based upon the info on this site, as well as you must never ever analyze or otherwise depend on any one of the info on this site as financial investment recommendations. We highly advise that you seek advice from a qualified financial investment consultant or various other certified monetary specialist if you are looking for financial investment recommendations on an ICO, IEO, or various other financial investment. We do decline settlement in any type of type for evaluating or reporting on any type of ICO, IEO, cryptocurrency, money, tokenized sales, safeties, or assets.

See complete terms.

Aave Will Build on Polygon’s Scalable Layer 2 Platform

Decentralized loaning system Aave states that it will certainly scale its DeFi system past the Ethereum blockchain by likewise signing up with numerous sidechains, consisting of Polygon. Aave Explores Polygon According to Aave, Ethereum’s…

Polygon Launches $40M Liquidity Mining Program with Aave

Polygon is releasing a liquidity mining program with hopes of drawing in liquidity to its network. Polygon Rewards Liquidity Miners Polygon, among Ethereum’s most crucial scaling services, is releasing a…

What Are Non-Fungible Tokens (NFTs)?

Tokenization is fit for assets like fiat money, gold, as well as physical land. A fungible property’s depiction on blockchain makes assets tradable 24/7 using indeterminate as well as smooth purchases. Fungible products are…

Polygon Transactions Explode After DeFi Expansion

Polygon’s on-chain task recommends rapid development over the last month, mainly driven by DeFi tasks broadening to the system. Polygon Experiences DeFi Growth As Ethereum encounters scaling problems as well as high…